Nowadays, many people have the desire and need to record their expenses in order to avoid unnecessary spending. Nevertheless, it can be extremely inconvenient to write down the amount of money spent in a notebook or in notes on a smartphone. Apps for keeping track of personal finances are created especially for such purposes. Their purpose is to help in planning personal income and expenses, as well as tracking transactions from a bank card. With the help of such apps, it is easy to record your spending in just a couple of clicks, as well as to categorize and manage your finances.

Functions and criteria of personal finance apps

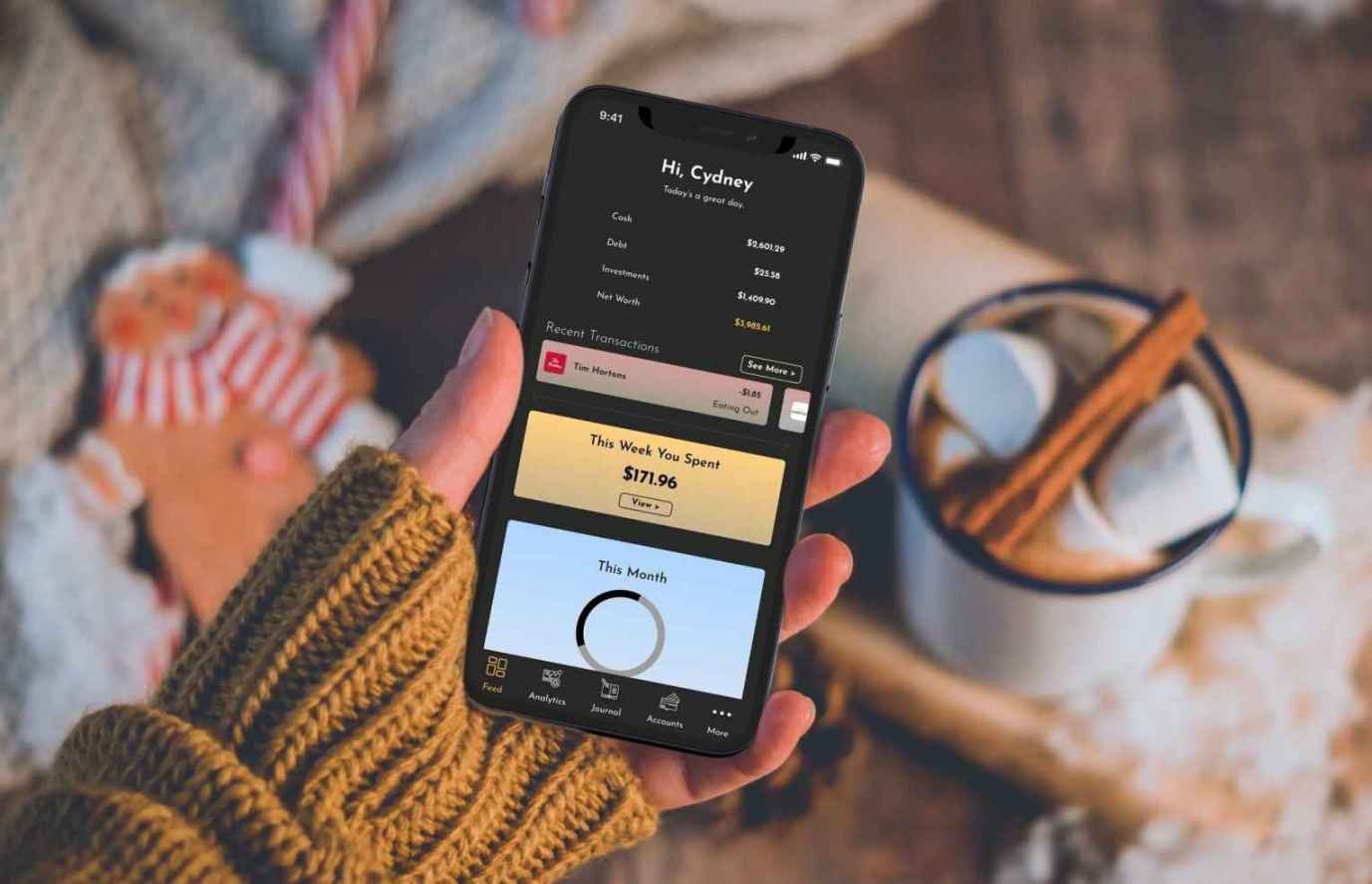

The main function of a personal finance app is to record income and expenses and provide a summary of them over time. Apps with good functionality are usually also linked to payment systems, which gives them the ability to notify the user of necessary payments, as well as automatically calculate the expenditure of funds.

When creating such an application from scratch, it is important to remember that the most important criteria when choosing this product for users are:

Ease of use – convenience and comfort are of utmost importance, because the ability to check your financial cycle with just a couple of clicks saves a lot of time. Observing this point is the most important part of product development.

Visual part – the use of diagrams and infographics in the application interface can significantly affect its usability. After all, the main thing for the user in this case is how organized and clear the information about his finances is.

Security – it is very important for users to avoid leakage of personal banking data. To prevent this from happening, when creating an app, make sure that the data is encrypted and stored on reliable cloud services.

Also, the app should definitely have two-factor authentication – when a user can authorize themselves with a password or code that can be sent to them in a text message, by phone or email. Also, when creating such a product, you can shorten the visit session to reduce the time in which the application can be used in an unsecured mode. In addition, it is important to use not too bright and noticeable fonts in the interface of the application so that the user can use it in a public place without fear of personal banking data leakage.

API for financial applications

API (App Programming Interface) is an interface program that allows applications to interact with other software. In the case of financial applications, this interaction is done with the software of payment systems, for example, Google Pay. An application for controlling finances requests transaction data from the payment system, and based on this, generates a chart or infographic with detailed items of user spending.

You can create an API for a financial application in different ways. The simplest of them is to use online services that allow you to create and test the application programming interface for free or for a small fee. The most important part of creating an API when designing and documenting it is its specification, which will allow other developers to understand how to interact with it.

All you need to get started with an API is a domain name, HTTP, and a place for code. The most common programming language option for creating APIs is Java, but Ruby, PHP and Net can also be used.

The advantages of creating API-based financial applications are as follows. First, in this way the developer can reduce the amount of repetitive code in the application. Secondly, only the users who own the data will have access to it. This will provide a secure user environment and guarantee trust in the developed product.