The Payback Period is the time it takes to justify the cost of an original cost through the cash flow calculations invested into the business. The payback period is a fundamental capital budgeting tool commonly used in corporate finance and is perhaps the simplest method for evaluating the validity of undertaking a potential investment or project. An online payback period calculator by calculator-online.net also aids in cash flow calculations for the whole past year. This is indeed a great advantage for all businessmen.

The number of months or years it takes to recover the initial investment is referred to as the payback period that could easily be determined by using a payback calculator for sure.

In this article, you will come to know about the ways that will help you to calculate the payback period easily.

Let’s have a look!

How To Calculate Payback Period?

The payback period is calculated as the amount to be invested divided by the estimated annual net cash flow. The following mathematical formula can be used to calculate the payback period:

Payback Period = Initial Investment / Annual Cash Flow For instance

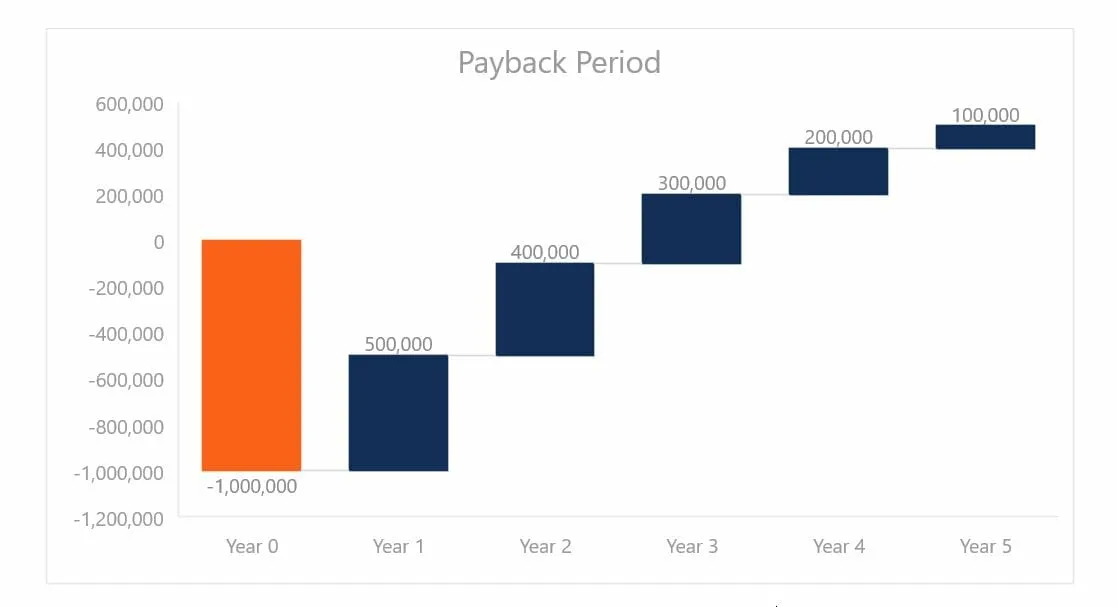

Suppose you invested $ 1,000,000 with an annual payback of $ 20,000.

Payback Period = $1,000,000 / $20,000 = 5 years

You can also verify the results with the best payback period calculator in seconds.

Investment Payback:

The formula for calculating the payback period of an investment is determined by whether the agency’s regular intervals cash inflows are even or irregular. If the revenues are even (as in an annuity investment), the payback period is calculated as follows:

Payback Period = Net Cash Flow per Period x Initial Investment

When cash inflows are random, we must compute the cumulative net cash flow for each period and then apply the following formula:

A + B + C = Payback Period

But the best way to determine the payback period is using a payback period calculator that does so for you instantly and accurately.

Where A is the last period number with a negative cumulative cash flow calculation, B is the absolute value (that is, the value without the negative sign) of cumulative net cash flow at the end of period A, and C is the total cash inflow during the period.

Discounted Payback Period Method:

The payback period calculation has one disadvantage in that it disregards the time value of money (i.e. the opportunity cost of receiving cash earlier causes it to be worth more). The discounted payback period calculator comes into play here.

In concept, the discounted payback period is a more appropriate estimate because it accounts for the fact that a dollar today is more valuable than a dollar received later. However, when it comes to investments/projects with longer payback periods, the importance of discounting the future profits becomes far more noticeable.

As a result, the discounted payback period calculates the amount of time required to recover an investment’s amount, but its formula uses the discounted value of the cash. This will make you a little bit confused. That is why we emphasize you make use of a cash flow calculator to do all this stuff immediately and precisely.

Footnotes:

Well, in this article, you understood the different formulas or methods that help you to calculate the payback of your business more easily. Also, the importance of the payback period calculator has been enlightened many times to perform cash flow calculations faster enough.