It is a matter of great satisfaction for any supplier when customers send you purchase orders and why not? After all, this is adding up to your order book and you smile to yourself saying, ‘The more, the merrier.’ After the euphoria of having bagged the order, settles down, it is time to execute the order and that’s when you realize that you don’t have enough cash in hand to process the order. What would you do then? Return the purchase order citing inability to deliver it or find a way out? This is where you need to approach an alternative funding company with your purchase order and apply for business funding. If you meet their minimal assessment criteria, you will get the funds within 24-48 hours.

Like invoice factoring, purchase order can be used to get funding

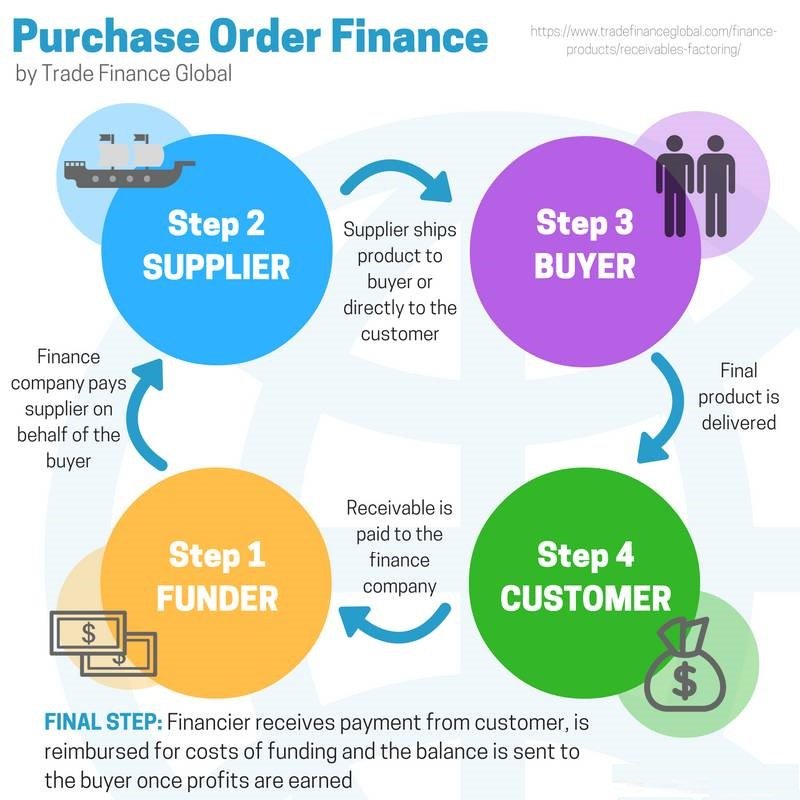

Just as you have invoice factoring wherein your unpaid invoice is leveraged to provide you with a small business funding, your unprocessed purchase order can also be leveraged to provide you a cash advance. Such funding will allow you to process the order on time and raise the bill or invoice. Your cost of borrowing is adjusted from the payment you receive for processing the order.

It is not really easy to manage a lot of business coming your way even though it is what every business owner wants. It should not be that you have to go for purchase order financing every time you receive an order. You need to manage your cash flow well enough to avoid the need for business funding every time you have an order to process.

Alternative lenders offer multiple funding options

Unlike traditional lenders like banks and other financial institutions, a company like Alternative Funding Group, offers multiple funding options to suit your specific needs. This company has distributed over $200 million to businesses of all sizes over the last 5 years. Most importantly, they offer a wide range of unsecured funds to meet urgent requirements.

It is no longer a problem for a small business to get quick and easy funding as they can now count on alternative business loans. It may be slightly costlier if you go for unsecured funds, but you apparently do it when there is scope for good profits in the deal for which you need the loan. Surely, you know the difference between the cost of borrowing and your profit margin from the deal; so use your own judgment.

You can also get unsecured funding at reasonable cost

It is not always that you have to pay more for unsecured funds as many lenders have unique funding solutions that lower your borrowing cost significantly. Businesses need regular bankrolling to support their operations and also to capitalize on the occasional big deals that help them grow.

However, you need to exercise restraint while borrowing and tighten up your expense outflows to be able to make best use of the business funding solutions that alternative lenders offer. It is important to develop good working relations with the funding company and the best way to do that is by servicing the debt professionally.